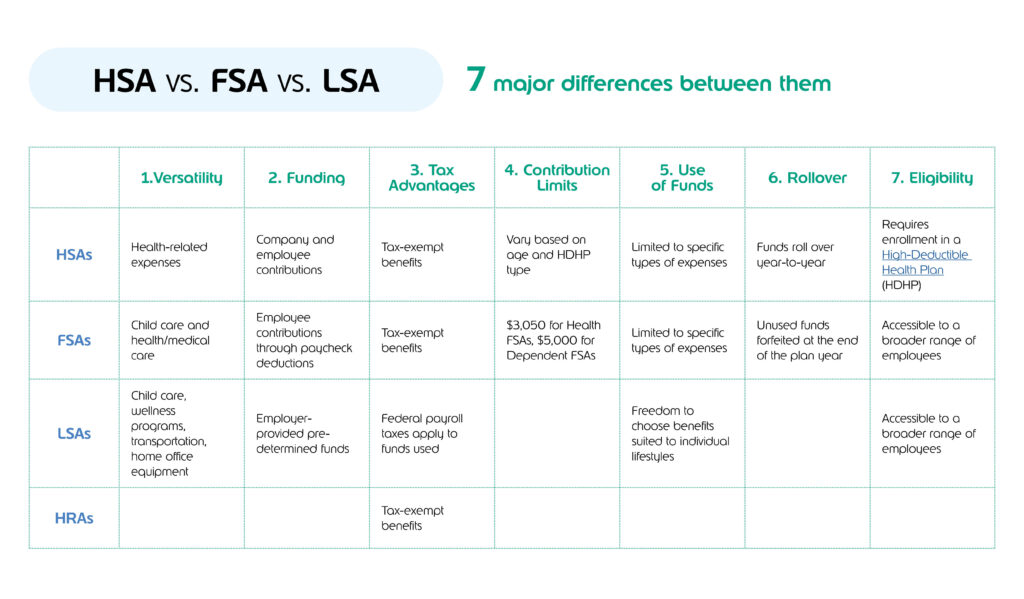

You’re likely familiar with Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), but have you heard of Lifestyle Spending Accounts (LSAs)? More importantly, do you understand the seven crucial differences among them? In this article, we’ll dissect these benefits, highlighting their unique features and the 7 differences between HSA, FSA, and LSA.

Differences between HSA, FSA, and LSAs: Why is it Important?

Employees and employers should understand the differences between HSA, FSA, and LSA. Why? Because everyone’s life is unique, and so are their needs. For instance, some companies may provide on-site cafeterias, while others offer meal allowances through debit cards. Similarly, companies may have hybrid workspaces, while others require full-time on-site presence due to the nature of their services.

Now, benefit offerings vary across companies. Employees desire the flexibility to customize their benefits to match their individual needs. This not only boosts morale and productivity but also fosters loyalty, resulting in a dedicated and engaged workforce.

To sum up, understanding the differences between HSA, FSA, and LSA is crucial for both employees and employers. With unique needs and preferences, selecting the right benefits package is paramount. This knowledge empowers employees to make informed choices, fostering loyalty and productivity. Explore the infographic for a clear breakdown of the key differences.

How to choose the right benefit for your company?

Choosing the right benefit for your company depends on understanding the differences between HSA, FSA and LSA and the needs and preferences of your employees. Here are some factors to consider:

- Diversity of needs: Each employee has unique needs and preferences. Some employees may already have a home gym or prefer alternative fitness options, while others may not require health or nutrition coaching. LSAs provide the flexibility to accommodate the diverse needs of your workforce, ensuring that each individual can choose the benefits that best suit them.

- Work-life balance: It’s best to choose offerings that promote a balanced lifestyle. LSA options geared towards boosting productivity are great, but focusing on some options that promote downtime and relaxation is important too.

- Tax benefits: If tax benefits are a priority, FSAs and HSAs offer tax-exempt benefits. The money in an FSA or HSA is not subject to income tax as long as it is spent on qualifying medical expenses.

- Budget: Consider your budget and the financial implications of each option. FSAs and HSAs have contribution limits, while LSAs can be customized based on your budget.

- Employee involvement: The more options you offer, the more talent you’ll attract as well as increasing employee satisfaction. Better yet, get them involved in having a say about those options and watch the company’s morale skyrocket!

You may also like:

- Employee benefits survey: Uncovering what your workforce really wants

- 5 ways to help employees live healthy lifestyles

Let your employees choose

Break away from the cookie-cutter approach to benefits. Give your employees the power of choice with LSAs, HSAs, and FSAs. Show them that their well-being matters by offering a range of options that cater to their unique lifestyles. If you understand the differences between HSA, FSA and LSAs, you’ll help your employees select the best company benefits. This makes them happy and loyal, which helps your company succeed.