This may come as a surprise, but current employees aren’t so sure you care.

This may come as a surprise, but current employees aren’t so sure you care.

At least that’s what high rates of employee turnover in industries including hospitality and retail, where hourly employment makes up an estimated 75% of the workforce, would seem to indicate. But what if something as simple as a lifestyle savings account (LSA) had the power to change this and possibly lower those turnover rates, too?

It does.

Okay, if you’re ready to stop reading because you, too, heard that the “Great Resignation” is officially over, hang on. While it’s true that 2023 turnover rates have dropped from their historically high 2022 rates, it’s also true that industries with large percentages of hourly workers, including hospitality, are still tracking 60% turnover rates for the year.

And that’s not quite cause for celebration. But it is justification for looking into why turnover is still high as well as how we can change things and boost employee retention.

Is a Lack of Concern for Employee Well-Being Driving Workplace Turnover?

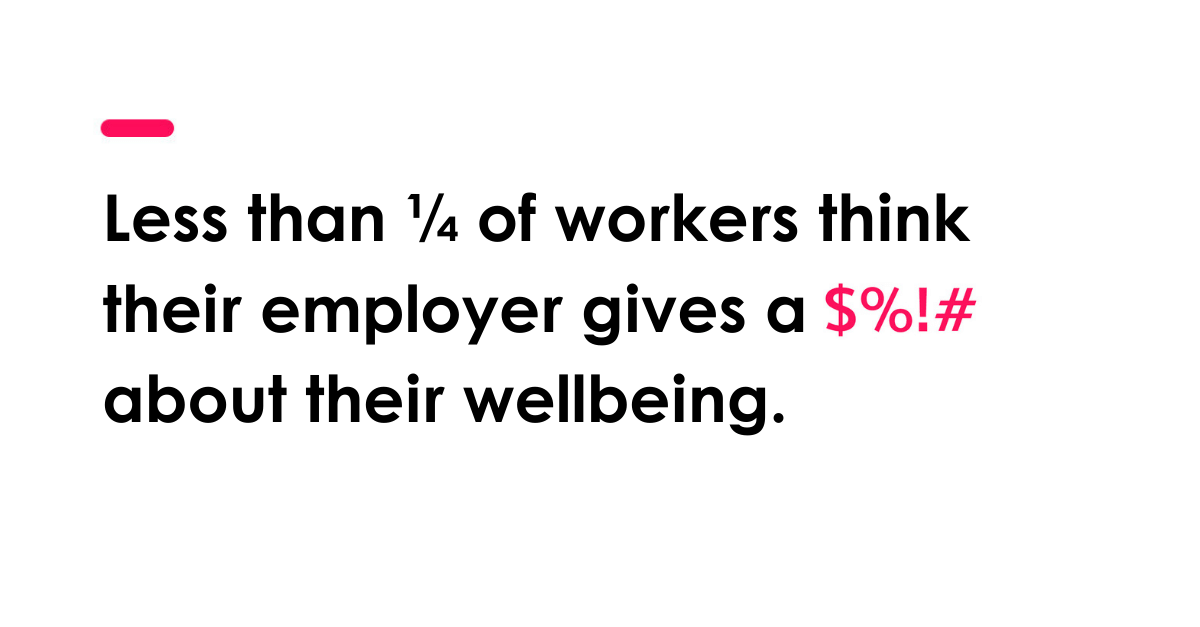

First, before you throw your hands up and toss aside all of the hard work you did building and nourishing a productive team over the past 3 years, here’s the truth: while most employers do care about employee wellbeing, employees somehow aren’t getting that message.

Blame the pandemic and the policies and practices employers implemented to accommodate employees so the work could go on even through mandated lockdowns. Work styles, hours, and locations shifted, and communication transparency was the name of the game. This sent workers a unified message: your well-being is our first priority.

Employees took notice. When Gallup polled more than 15,000 in May 2020, 49% of them strongly agreed that their employers were concerned about their well-being.

But when the economy restarted and workplaces reopened, perceptions shifted — drastically and quickly. Supply chain shortages and unmet consumer demand skyrocketed. Businesses that had shut down had a lot of lost time to make up for.

This need to restart the economy and keep up with demand triggered a race for employers to get bodies in place to do the job, which led to increased competition for workers. Hourly workers in hospitality reported salary gains exceeding 21%; construction came in a distant second at 12%, according to the Wall Street Journal. Inflation was high but even it was seriously out-paced by the salary gains in these mostly hourly industries. And competition for workers exploded.

Enter the Great Resignation. CNBC reported in early 2023 that 50.5 employees participated by leaving their job. Most of the “resigned” remained in the workforce, however: they simply took new jobs elsewhere. So while the Great Resignation is always pitched as an event of departure, we could look at it from the other angle, too: employees just left employers, not the workforce. Where did they go? To a new employer.

But why? What was wrong with their old employer (who was likely still hiring, too)?

Gallup research found that perceived employer concern about workers’ well-being plummeted year over year to a low of 24%. You read that right: less than ¼ of employees surveyed in 2022 believed their employer cared about that employee’s well-being.

How Showing Concern for Employee Well-being Can Boost Retention

Gallup’s research looked at the big picture from another angle too: what was life like for the 24% of employees who did feel their well-being was top of mind for their employer?

- 69% were less likely to search for a new job

- 71% less likely to report burnout

- 5X more likely to advocate for their company as a place to work

- 3X more likely to be engaged at work

- 36% more likely to be thriving in their overall lives

SOURCE: Gallup

But how can an employer show it cares? Gift cards and catered lunches only go so far. In some industries, the ability to work from home translated to concern. But certain hourly roles, including hospitality, retail, and construction, don’t offer a lot of opportunities that can be work-anywhere or work-anytime.

In those industries, jumping to a new employer who offered the same basic work structure and style was likely to hinge on other factors, including pay, which is where that 21.9% wage gain comes into play. If an employer lacks a key differentiator that sets its employer brand apart from the rest, an extra $1/hour in pay is worth the jump for an hourly worker (and probably plenty of salaried employees, too).

Raising Pay and Promoting Health Benefits Isn’t Enough to Stop Hourly Worker Turnover

Great Resignation or not, if you’re an employer vying for a piece of the worker pie — whether in terms of retention or recruitment — you need to provide a solid motivator that attracts and retains your workforce. Historically, the motivators involve salary and benefits. But there’s a problem with the traditional approach to these:

1. The wages you offer are only “the best” until the next business beats your offer.

We saw this in 2021 and 2022 and ultimately it boosted hourly worker pay across the board. But it also became a major contributor to high inflation. Wages still trump all in terms of employee turnover. But eventually increases top out across industries. Even now, we’re seeing wage increases being out-paced by inflation.

2. Benefits like employer-sponsored health insurance are enticing but

the Affordable Care Act actually reduced the power of the health benefit offered by employers. Between the Healthcare.gov’s HealthInsurance Marketplace, compliance that requires businesses employing at least 50 full-time workers to provide healthcare coverage to employees, and other requirements that pre-existing conditions be covered, employees have less of an attachment to a specific employer’s healthcare plan.

When wages and health benefits are off the table for retaining workers, there’s little left for employers to bargain with. Culture and employer brand are key to success here … until you learn that employees are getting your message.

How an LSA with Customization Becomes an Employer-Brand Differentiator

Strong employer brands benefit everyone associated with a business. The most successful ones ensure the brand is embraced by current staff, too, who act as advocates for the message. A LinkedIn report found that a strong brand not only impacts recruiting but also retention:

If an organization has a strong employer brand, especially one that resonates with current employees, it will also have a significantly lower turnover rate. Our research indicated that companies with a stronger employer brand have a 28 percent lower turnover rate than companies with a weaker employer brand.

If you ask employers, business owners, and HR leaders to list a company’s greatest commodity, at the top of each one’s list is “employees.” The team matters more than anything. Happy workers have a positive outlook on business that extends to their direct and indirect interactions with clients and increases customer satisfaction, too. Empowered teams feel equally empowered when working with customers. Problems get solved confidently.

So when you’re boosting retention and also targeting recruiting goals, the logical step is to build an employer brand that sets you apart from every other workplace. How do you do that in 2023? By ensuring your brand says you care about employees and not just what they can accomplish while at work. Plus, if all things salary- and benefits-related are virtually equal for an hourly worker, that means you need another differentiator to pick up the slack.

Enter the LSA or Lifestyle Spending Account, the employer-sponsored benefit that isn’t required like health insurance, it’s prescriptive or restrictive like a workplace wellness program, and isn’t likely to be outdone by the competitor next door.

The LSA becomes the differentiator that says your employer brand cares about worker wellbeing. Here’s why:

-

- Employees can choose how they spend their own benefits; you don’t tell them what matters — they decide for themselves.

- Employees spend LSA funds for enjoyable or meaningful actions rather than only seeing a payout at the worst possible times, like when an emergency arises, which is largely the case with employer-sponsored healthcare plans.

- LSA benefits are aligned with an individual employee’s personal interests and well-being choices.

- Employers can direct coverage areas of a Lifestyle Spending Account to align with the employer brand’s wellness and lifestyle image.

- Employees can choose how they spend their own benefits; you don’t tell them what matters — they decide for themselves.

The combination of individuality and customization is what sets an LSA apart from the prescriptive requirements of a competitor’s workplace wellness plan (“Did you log your 10,000 steps today?”) or a travel benefit (“Sorry, we don’t have a hotel in that area”). Plus employees don’t need to pick and choose which benefits to opt into. Depending on how an employer configures its LSA, an employee can access all or any of the benefit categories at their discretion.