Have you ever considered what your benefits are saying about your employer brand? Is it: “We’re innovative, experience-focused, and fun,” or “We love nature and the environment but occasionally have to work too”? Maybe “We’re driven by our moral compass to leave the world a better place,” or “We’re a group that celebrates each other as individuals”?

Or are your benefits sending a more stoic message: “We do what’s expected and what’s required by law. Period.”

Benefits are a key part of the image your company conveys to employees and prospective employees. Employer review sites include feedback on benefits. Rankings of top workplaces grade employers on benefits, too.

Still, not every employer’s benefits need to be identical or even the most outrageous or best. What they do need to be is sending the right message about your business to the employees you want working with you most.

Employee benefits that say “innovative” vs “don’t rock this boat”

Health insurance. Retirement. Paid time off. These are still the big 3 benefits for employees. Deemed “traditional benefits,” each has evolved from a nice-to-have bonus for workers to must-haves and expectations for most full-time workers.

Not long ago, a “Cadillac” health plan would have been seen as a draw for job candidates, but the Affordable Care Act leveled the playing field somewhat. Additionally, its pre-existing-condition coverage requirements meant any employee could have the freedom to roam to a new employer’s health plan and still have coverage.

Because of the ACA’s changes, even smaller organizations that aren’t legally required to offer health benefits were able to be more competitive either through providing employer-sponsored health coverage or by giving employees an allowance for health-benefit purchasing on Healthcare.gov’s HealthInsurance Marketplace.

In short, hanging your hat on an employer health insurance plan as a key benefit today doesn’t really resonate with recruits, at least not for larger companies.

This is where non-traditional benefits step in as differentiators. This category of benefits includes options more aligned with personal wellbeing and can often be customizable by both the employer and the individual employee participant. The result is a benefit that puts the employee in charge of how their money is spent. Examples of non-traditional benefits include:

Lifestyle benefits and lifestyle spending accounts (LSA). A large category of flexible benefits that can be used for various health, fitness, and well-being options. Depending on the specifics of individual employer plans, an LSA may be used for anything from gym memberships and workout gear to financial planning, education, massage therapy, entertainment, pet insurance, and more. Workplaces themselves benefit from LSA-related reductions in stress, improvements in morale, and greater overall productivity.

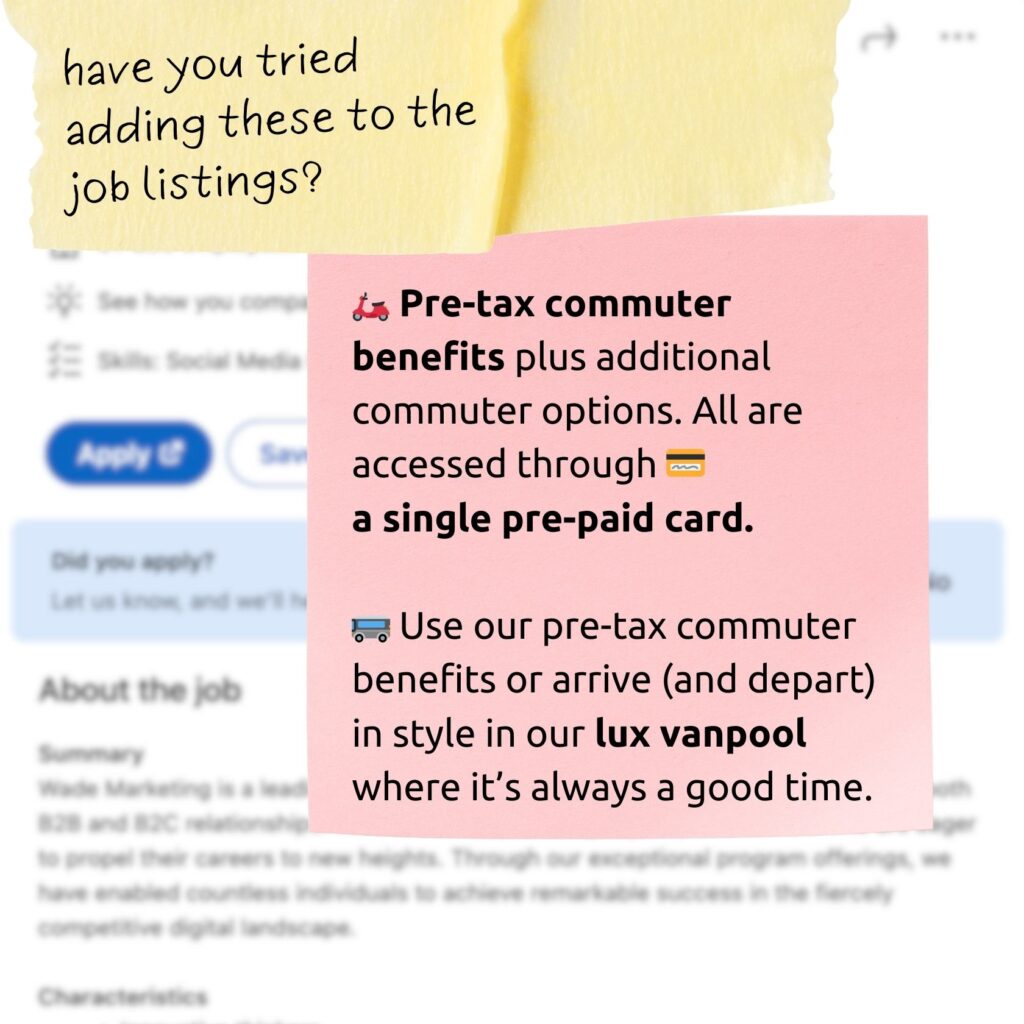

Commuter benefits and mobility options. Required for compliance in some locations in the U.S., commuter or transit benefits give employees the opportunity to use tax-free dollars on specific commuting costs. Mobility benefits increase the options with post-tax dollars and give employees additional choice in how they commute. Employers can also make contributions or “fund” accounts on behalf of employees, and employee contributions can be set up as payroll deductions. For pre-tax commuter benefits, this can also save money on the employer’s payroll taxes.

Pay-related benefits. Anytime- and on-demand pay allows employees to access wages from their next paycheck early when needed. Funds, up to a specified limit, can be available almost immediately.

Wellness benefits. Traditional wellness programs reward employees for setting and meeting specific health-related goals including exercise, sleep, and more. Similar but more-flexible benefits options are also covered by more comprehensive LSAs.

Experiential benefits. Employee benefits programs that cover experiences and may include anything from learning and entertainment to travel or employer-funded vacations and sabbaticals. These benefits may also be incorporated into more comprehensive, employee-directed LSAs.

Should Your Benefits Focus More on Job Recruiting or Employee Retention?

Not sure whether to focus on employee retention or job recruiting with your benefits? Consider this: how a great marketer spins your benefits to a recruit means a lot. But how your current employees describe and use your benefits may mean even more to your employer. Here’s why:

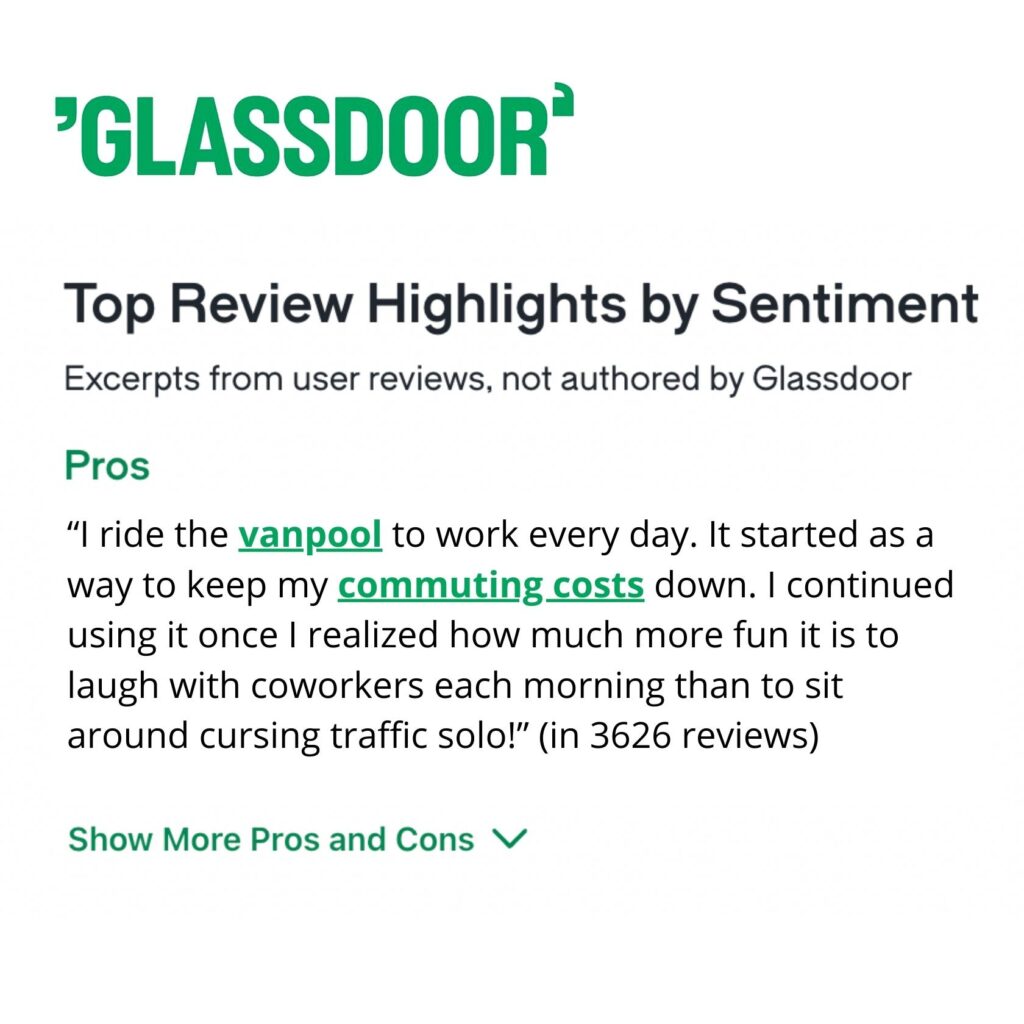

- Wide-ranging, individually-centered and directed benefits plans can turn your current employees into advocates and influencers promoting your employer brand. Want proof? Check reviews on Glassdoor. Ensuring current employees are satisfied with the benefits you offer becomes even more important since this influences their decision to stay and their attitudes towards the workplace. The latter will trickle down to job candidates, too, who’ll get a clearer assessment of the overall value of the compensation package you offer.

- It’s a lot easier to get feedback on the benefits you already do and should offer from current employees. You just have to ask.

BTW, this is another great reason to ensure your own team knows the benefits available to them and uses them, too. Is this actually a problem? Yes. A 2021 survey by Voya Financial found that 35% of employees surveyed didn’t understand the benefits they enrolled in during open enrollment; for younger workers, that number was higher: 54%.

If you offer a slate of cool, non-traditional benefits or even a customizable commuter benefits plan but no one uses them, info about these cool benefits never goes beyond your site’s Careers page. Offering year-round benefits education can help and was something that between 66 and 78% of respondents in the same Voya Financial survey indicated they wanted.

Which benefits are making you seem dull? Think like a recruit.

In addition to asking your own team what they want in terms of benefits, spend some time looking at competitors’ career pages and job postings. What benefits are others in your market or industry promoting to sweeten the employment offer? Pay careful attention, too, to how your market competitors discuss their benefits. Even consider charting the different options touted so you determine how to stand out in your industry or region (a great intern project, BTW).

Then get creative with the benefits you select and how you talk about them publicly. For example, if you operate in an area where commuter benefits are required by law, opt for a plan that goes further than just the bare minimum and includes the ability to add more mobility services. Once you launch the more flexible commuter benefit coverage, be sure to tell people.

Also consider adding honest, positive feedback from your current employee.

Ways that your benefits can impact a decision to change jobs

A few years back (2015), Glassdoor published a survey indicating that 79% of employees would choose new or better benefits over a pay increase. The number was greater for women (82%) and for men (76%), and for younger employees (ages 18-34; 89%) than older workers (5-64; 55%).

More recently, in Spring 2023, CBSNews reported on what convinces today’s workforce to take a role at a new company. Using stats collected from The Muse, a career-development site, CBS noted the following motivations:

70% Improved work-life balance

67% Better pay

59% Increased learning and growth opportunities

59% Desirable culture and colleague likability

58% Better job perks and company benefits

47% Increased job security

41% Company leadership

While benefits are number 5 on the list of reasons, they also contribute to numbers 1, 3, and 4 on the list in the following ways” LSAs can be customized to improve employees’ work-life balance and to cover learning expenses leading to growth. Plus, giving your employees options about how they want to use LSA or commuter benefits speaks volumes about the value you place on the individual.

Emphasize employer brand and mission with customized benefits and employer funding

To really emphasize your employer brand, ensure you’re selecting benefits that mirror it. Then present those same benefits to illustrate how they connect to your mission..

Where stating that you provide employee health insurance options simply shows you comply with the ACA (unless you’re a small company that isn’t required to comply), adding a commuter benefit plan when you’re not required shows your brand is both committed to helping employees save money and to improving the environment. Emphasizing both physical and mental wellbeing in your LSA conveys a commitment to employee mental health, too.

Are you also contributing to your employees’ plans? Tell recruits and remind employees about it (the latter can improve participation rates). While contributions to an employee health savings account or flexible spending account are common now for larger companies, employer contributions to commuter benefits or lifestyle spending accounts can still serve as a differentiator, particularly in markets where other employers don’t offer similar benefits funding.

A bonus you may have missed: simple-to-use benefits plans

One final note about benefits: getting more employees to use the ones you offer and love the ones you offer should be at the top of every HR team’s to-do list. One way to encourage sign ups and adoption of non-traditional benefits? Make them simple to use.

Research in 2012 determined that a connection exists between employee use of benefits and higher job satisfaction. But researchers also found that “simply offering family-friendly benefits will not lead to enhancing organizational outcomes if the utilization rate is low, due to a lack of a supportive culture.”

So how do you ensure your culture feels supportive of employees using non-traditional benefits? Start with access: ensure your plan has a debit card or other payment method for employees to access all nontraditional benefits, don’t need to save receipts or remember what’s reimbursable, and have a single login that accesses all accounts whenever needed.

Need more info about how you can get all of this in your non-traditional benefits programs? Get in touch.